United States liquor exports to Canada saw a staggering 85% decline in the second quarter of 2025, highlighting the growing strain caused by renewed trade tensions between Washington and Ottawa.

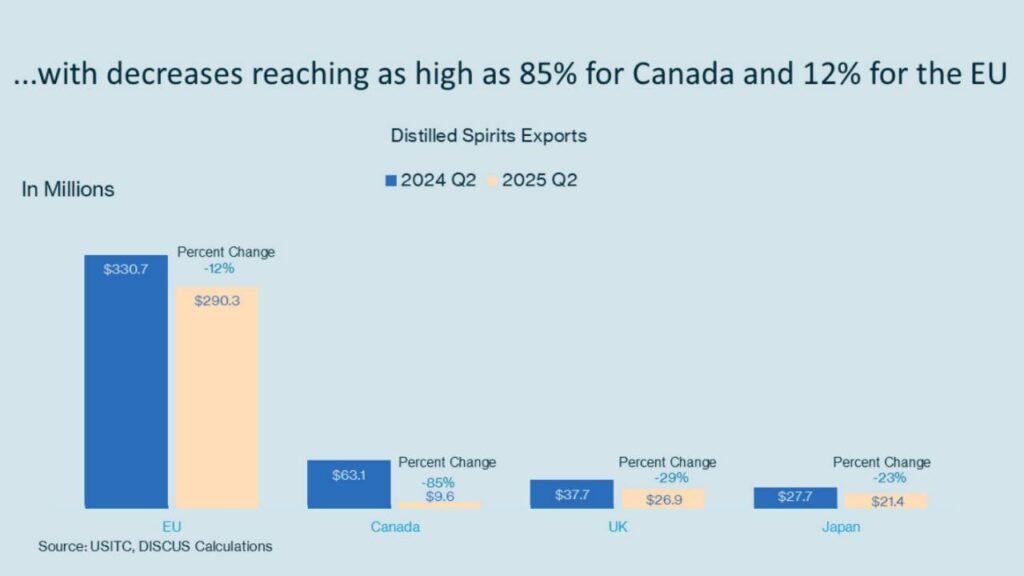

According to a midyear report released Monday by the Distilled Spirits Council of the United States (DISCUS), exports fell to just $9.6 million, compared to $63.1 million during the same period in 2024.

The sharp drop reflects the fallout from President Trump’s latest round of tariffs announced earlier this year.

The administration imposed a 35% tariff on Canadian goods, reigniting disputes that had largely cooled after the U.S.-Mexico-Canada Agreement (USMCA) went into effect during Trump’s first term.

While goods covered under the USMCA remain exempt, Canadian provinces have continued to push back against American liquor imports.

“Despite the removal of most counter-tariffs on September 1, the majority of Canadian provinces continue to block U.S. spirits from their shelves,” the DISCUS report noted.

“Canada remains the only key trading partner to retaliate directly against U.S. spirits.”

Also See: Investors Rush to Gold as Prices Near Record $4,000 Mark

The liquor industry’s troubles in Canada mirror a broader global downturn for American distillers. Overall, U.S. exports of distilled spirits fell 9% year-over-year, dropping from $651 million in Q2 2024 to $593.6 million in Q2 2025.

The European Union, the largest market for American spirits, saw a 12% decline in imports, while shipments to the United Kingdom plunged 29%.

Japan, another important market, recorded a 23% decrease in U.S. liquor imports.

DISCUS President and CEO Chris Swonger expressed concern about the industry’s trajectory, warning that “persistent trade tensions are having an immediate and adverse effect on U.S. spirits exports.”

Swonger added that international consumers are increasingly favoring locally made or non-U.S. spirits.

“There’s a growing concern that our international consumers are turning away from great American spirits brands,” he said, calling for a renewed commitment to zero-for-zero tariffs – a policy framework that previously ensured free trade among major spirits-producing nations.

“With domestic demand slowing, it is critically important that U.S. distillers have the certainty of tariff-free access to key markets, including the EU and UK,” Swonger emphasized.

“For decades, our industry was a model for fair and reciprocal trade.”

In response to the report, the White House defended President Trump’s trade policies, arguing that they are designed to secure long-term market advantages for American producers.

“President Trump’s trade agenda has created unprecedented access to markets worth over $32 trillion, serving more than 1.2 billion consumers,” said White House spokesperson Kush Desai.

“As these deals and pro-growth policies take effect, it’s going to be bottoms up for American distillers, brewers, and winemakers.”

However, industry leaders remain skeptical. With exports plunging across key global markets, analysts warn that sustained tariffs could weaken America’s competitive position in the global liquor trade – a sector that has long been one of the country’s most successful cultural and economic exports.

If the current trend continues, U.S. distillers may face not only declining international sales but also a long-term loss of brand presence in markets that once embraced American whiskey, bourbon, and vodka as symbols of craftsmanship and quality.