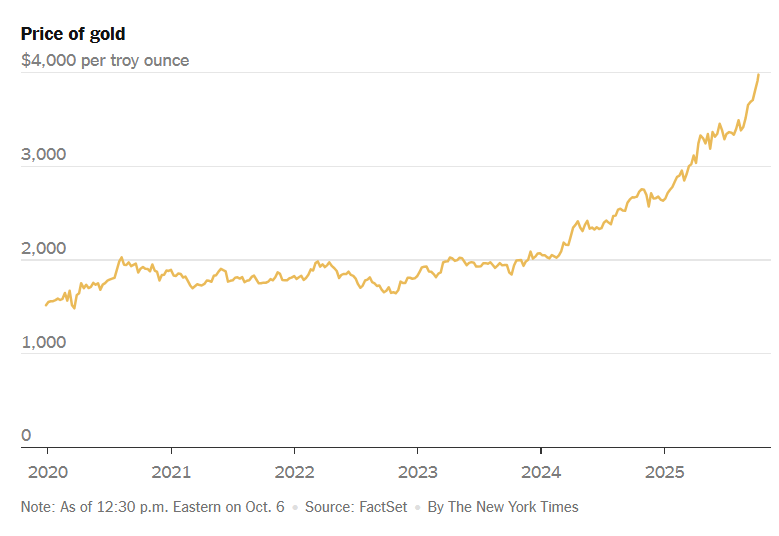

The Gold Price has soared to an unprecedented $4,000 per ounce, marking a historic milestone for the precious metal.

This surge reflects deepening investor anxiety over geopolitical tensions, persistent inflation, and the economic uncertainty surrounding U.S. fiscal policy and global markets.

On Tuesday, gold futures traded at $4,005.80 per ounce, extending a remarkable rally of more than 50% this year.

Analysts attribute the rapid climb in the Gold Price to a combination of factors from the Federal Reserve’s recent interest rate cuts to growing concerns about the stability of the U.S. dollar and creditworthiness.

President Donald Trump’s trade and monetary policies have also contributed to the surge. His confrontations with the Federal Reserve and a series of aggressive trade measures have rattled investors, leading many to seek shelter in gold, long considered a safe haven asset during volatile times.

Financial institutions and central banks worldwide are joining the gold rush. Governments are purchasing gold to hedge against potential U.S. sanctions and a weakening dollar, while retail investors are flocking to the metal to protect their wealth against inflation.

“The rally in gold has been largely driven by uncertainty – geopolitical, economic, and monetary,” said Ryan McIntyre, senior managing partner at Sprott, a leading precious metals investment firm.

The Federal Reserve’s decision to cut interest rates in September has been a key catalyst, with markets anticipating two additional rate cuts later this year.

Also See: Investors Rush to Gold as Prices Near Record $4,000 Mark

Lower rates tend to weaken the dollar, making gold more attractive for international investors.

Bank of America, however, has urged caution, warning that the Gold Price may face “uptrend exhaustion,” which could lead to a temporary correction or consolidation in the coming months.

Despite this, gold remains on track for its best year since 1979, when prices more than doubled during a similar mix of high inflation, a depreciating dollar, and Middle East tensions.

Adding to the uncertainty, recent political turmoil including a U.S. government shutdown and leadership shifts in Japan and France has further bolstered gold’s appeal.

Traditional safe havens such as the dollar, U.S. Treasury bonds, and the Japanese yen have weakened, leaving gold as the preferred refuge for anxious investors.

With global instability showing no signs of easing, experts believe that the Gold Price could remain elevated through year’s end, solidifying its reputation as the ultimate safeguard in turbulent times.