When it comes to robotics stocks under $20, one name stands out: UiPath Inc. (NYSE: PATH). If you’re scanning the market for automation plays that may offer both growth potential and a relatively low entry price, UiPath deserves your attention.

Below, we break down what makes UiPath stock interesting and what risks to consider.

What is UiPath & Why It’s a Robotics Stock to Know

UiPath is a software company that specializes in robotic process automation (RPA). Simply put, its platform helps businesses automate repetitive digital tasks things that once required human time and effort.

With embedded tools for AI, machine learning (ML), and natural language processing (NLP), PATH aims to streamline workflows across industries such as finance, healthcare, insurance, and more.

It also has global reach, with operations spanning the U.S., Europe, and other markets. This gives it exposure to several growth levers and diversified risk.

Financials & Recent Performance

Here are some of the recent numbers that help explain why many analysts are still watching UiPath stock:

- Revenue growth has been moderate but consistent. The company reported about a 14.6% year-over-year increase in revenue in one recent quarter.

- Gross margin is strong—about 83.09%, which is excellent for a software/automation business. That means UiPath keeps a large portion of revenue after direct costs are subtracted.

- As of this year, UiPath has finally posted a small net profit, with its “earnings” showing signs of positivity—though net margins are still thin.

- Annual Recurring Revenue (ARR) is growing. For a subscription-heavy business like automation software, a rising ARR base is a good indicator of customer retention and future revenue visibility.

Also See: 2 Dividend Growth Stocks Beating Inflation and Growing Payouts

Current Valuation & Analyst Perspective

Here are the valuation insights and market sentiment around PATH:

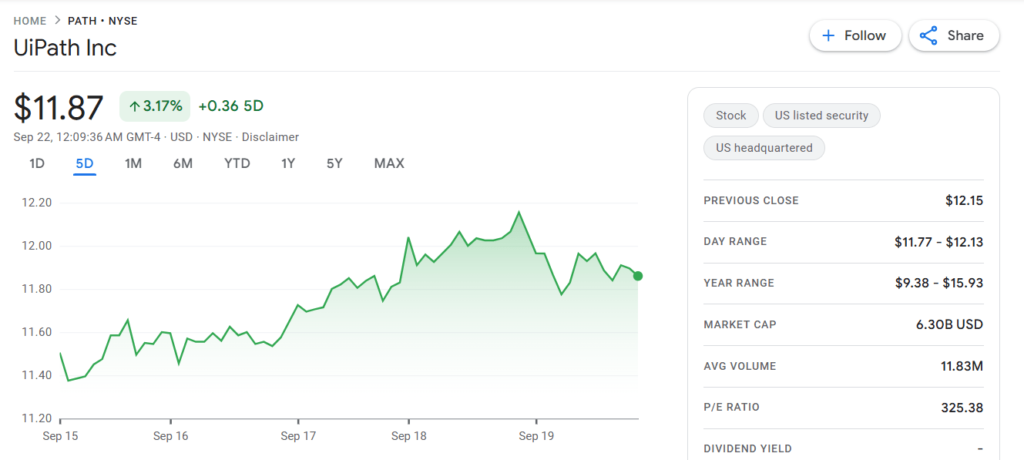

- The 12-month price target from many analysts sits around $13–$14, representing roughly 10–15% upside from recent trading levels in the low-to-mid $11–$12 range.

- Analyst consensus tends toward “Hold”, not a strong buy. Some firms have “Buy” ratings, but these are in the minority.

- Hedge fund and institutional holders are still involved—about 60–65% of the shares are held by such large investors.

These pieces suggest that while UiPath stock may not be racing upward overnight, many players believe its fundamentals are solid enough to hold, invest in, or accumulate at current levels (i.e. under ~$20).

Why PATH Might Be Undervalued or Risky

Upside Potential

- Agentic Automation and AI Expansion: One of UiPath’s key growth vectors is “agentic automation” — systems that do more than just repeat tasks; they decide, interact, adapt. As AI becomes more central to enterprise software, PATH is positioning for larger deals and broader use cases.

- Strong Margins & Improving Profitability: With high gross margins and emerging net income, there is some leverage for PATH to scale profitably, particularly if revenue growth accelerates.

- Price is Moderately Attractive: Because PATH trades under $20 now (roughly in the $11–$13 range), it offers a lower-cost entry into the robotics/automation sector compared to pricier peers. For investors who believe in the long-term growth of automation, that’s appealing.

Risks to Consider

- Growth Is Not Explosive: Revenue growth has been modest (low double digits), and billings or cash collections have at times plateaued.

- Guidance & Macro Headwinds: The company has issued cautious guidance in past quarters, partly because of macroeconomic factors (like U.S. government budget cuts) affecting customer spending, especially in the public sector.

- Valuation Risks: Even though PATH is under $20, the P/E ratio is very high (because profits are small relative to its valuation), so the stock’s performance depends heavily on continued execution and future earnings growth.

Also See: This 5.6% Dividend Stock Pays Canadians Every Month – Here’s Why It’s a Smart Buy

Should You Buy UiPath Stock (PATH)?

If you believe robotics stocks will continue their rise, particularly RPA plus AI, UIPath stock has a lot to offer.

It’s not a slam dunk, high-growth play like some purely AI/ML startups, but for investors seeking a relatively lower-price entry into the automation space with a company that has real enterprise traction, UiPath (NYSE: PATH) remains one of the more compelling options under $20.

For conservative or long-term investors, PATH could be a buy to hold especially if the company continues to deliver on ARR growth, margins, and expands its AI/automation features in meaningful ways.

If you prefer higher growth (but possibly higher risk), it might be worth comparing PATH to other AI‐heavy names that are trading at higher multiples and may offer more explosive upside albeit with more risk.

The Billionaire Brain Wave

Unlock the power of mindset to complement your investment journey into automation and robotics.

The Billionaire Brain Wave is a science-backed audio ritual designed to activate your brain’s Theta wave for 7 minutes a day, helping manifest financial abundance.

As you weigh UiPath stock (PATH) and explore robotics stocks under $20, pairing your investment strategy with mental clarity could sharpen your focus and resilience.

Hundreds of users across 70+ countries report stronger intuition, more opportunity, and surprising financial progress.

Try it risk-free with a 90-day guarantee for just $39 you can tap a new level of wealth mindset.