If you’re a millennial aged between 30 and 45, you’re likely navigating a whirlwind of life milestones. Career growth, raising school-aged kids, managing a mortgage… life is full, and the importance of building financial security is becoming more pressing every day.

You still have time to grow a meaningful nest egg, but time starts to race.

Many of you are saving, and some are even investing. However, as Finpres in-house research reveals, millennials tend to gravitate heavily toward growth stock strategies while underweighting dividend stock options understandably so.

After all, growth seems more attractive when you’re not counting dollars for today’s expenses. Yet, as retirement edges closer, it’s wise to introduce balance with stable, income-generating investments.

Let’s dive into Coca-Cola, a classic dividend stock, and explore why Coca Cola stock could be the ideal stock for millennials building long-term wealth.

1. Brand Power and Portfolio Diversity

Owning Coca Cola stock is not just about investing in the iconic soda; it’s exposure to a vast beverage empire. Beyond Coke, the company owns Sprite, Barq’s Root Beer, Gold Peak tea, Powerade, Minute Maid juices, Dasani water, Smartwater, Vitaminwater, and more.

This diverse portfolio caters to shifting consumer tastes, giving Coca-Cola a resilience few can rival.

As customers navigate economic ups and downs, many continue buying drinking basics out of habit – choices that are affordable and familiar.

2. Marketing Leadership in Tough Markets

The Coca-Cola Company dominates shelf space with unmatched marketing muscle. That prominence isn’t about fairness – it’s about dominance. As an investor, you want companies that not only survive downturns but thrive.

Coca Cola stock fits that bill, offering both stability and the aura of strength.

3. Predictability Through Dividends

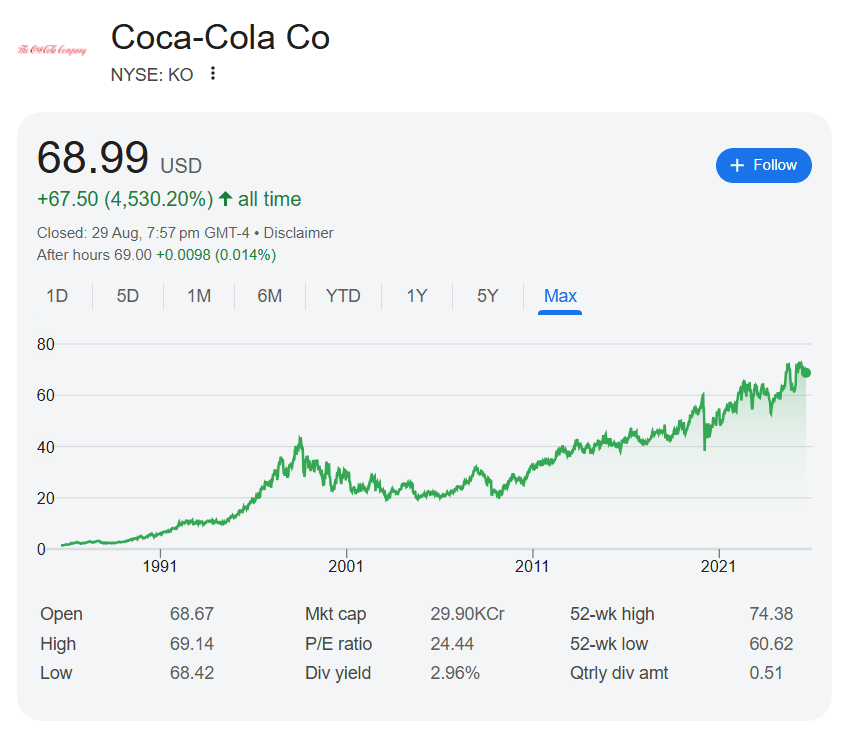

One of the strongest reasons to consider Coca-Cola stock is its dividend pedigree. Few companies have raised their dividend stock payouts for as many consecutive years as Coca-Cola has over six decades and counting.

That dependable record suggests even when markets wobble, this dividend stock continues rewarding shareholders.

New investors tapping into Coca-Cola stock today will find a forward-looking dividend yield hovering just under 3% not spectacular for income hunters, but solid for those looking at both yield and growth.

Also See: 3 Top Stocks to Buy in September as AI Fuels U.S. Market Momentum

4. The “Forever Stock” for Balanced Portfolios

For millennials, who balance growth potential with risk management, Coca-Cola stock presents a compelling case.

It may not skyrocket in a single year but its reliable dividend, brand strength, and consumer staples status make it a backbone for long-term portfolios.

Pairing some Coca-Cola stock with growth plays creates a balanced, resilient foundation.

Summary Table

| Why It Works for Millennials | What It Offers |

|---|---|

| Habit-driven consumer demand | Consistent revenue base |

| Marketing dominance | Competitive edge |

| Long-term dividend growth | Predictable income |

| Under-3% yield today | Modest but sustainable returns |

Millennial investors aren’t just saving, they’re building legacies. When adding stock selections to your portfolio, don’t skip dividend stock opportunities like Coca Cola stock.

It offers a blend of growth and consistency, making it a strong candidate for both your early-stage strategy and your retirement-ready plan.

The Billionaire Brain Wave

Want to elevate your investing mindset while building wealth?

Explore the Billionaire Brain Wave – a digital audio program powered by neuroscience that uses theta-frequency sound tracks to prime your subconscious for success.

With just a 7-minute daily listening routine, it aims to reshape your mindset for clarity, creativity, and abundance.

Alongside the core audio, you get a Quick-Start Guide and bonus materials like “The Warren Buffett Pyramid,” “7 Lazy Millionaire Habits,” a “Quick Cash Manifestation” track, and real success stories.

All accessible for a one-time investment of around $39 and backed by a 90-day money-back guarantee.