Investors often look to dividend-paying stocks as a way to generate steady, predictable income. With Alphabet now paying a dividend and remaining at the center of major market discussions, many income-focused investors are asking a practical question: How realistic is it to earn $500 per month from Alphabet stock?

Alphabet has recently drawn attention on multiple fronts. The European Commission has opened an antitrust investigation into Google’s use of publisher and creator content for training artificial intelligence models, keeping regulatory risk in the spotlight.

At the same time, Wall Street sentiment remains constructive. A leading analyst recently reaffirmed a bullish outlook on Alphabet, raising the stock’s price target and signaling confidence in the company’s long-term growth prospects despite near-term volatility.

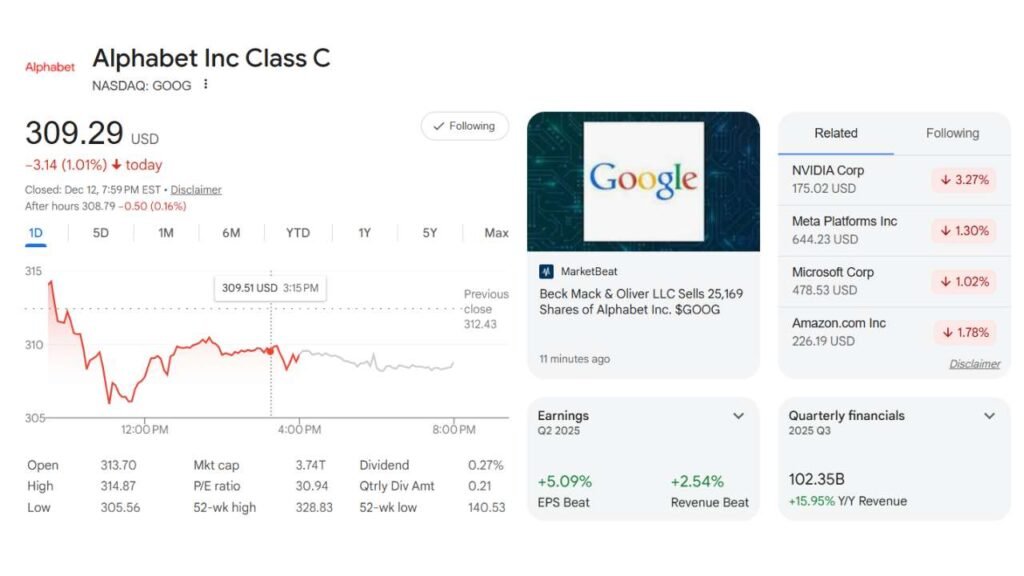

Alongside growth potential, Alphabet now offers a modest dividend. The company currently pays 21 cents per share each quarter, or 84 cents annually, which translates to a dividend yield of approximately 0.27%.

While that yield is low compared with traditional income stocks, the sheer scale and stability of Alphabet make it appealing to certain long-term investors.

To understand what it takes to earn $500 per month in dividend income, the math begins with setting an annual goal. A monthly income of $500 equals $6,000 per year.

Dividing that figure by Alphabet’s annual dividend of $0.84 shows that an investor would need approximately 7,143 shares.

At recent share prices, that equates to an investment of about $2.23 million. This calculation highlights an important reality: Alphabet’s dividend alone is not designed to support a high monthly income unless an investor already controls a substantial amount of capital.

For investors with more modest income goals, the numbers become more approachable, though still significant. A target of $100 per month, or $1,200 annually, would require roughly 1,429 shares.

Based on current pricing, that represents an investment of approximately $446,000. Even at this lower income level, Alphabet’s dividend strategy favors capital preservation and growth over immediate income generation.

Also See: Alphabet Seen Poised to Join $5 Trillion Club by 2028 as AI Momentum Accelerates

It is also critical to understand that dividend yield is not a fixed figure. Yield is calculated by dividing the annual dividend by the stock’s current price, meaning changes in either variable affect the outcome.

If Alphabet’s share price rises while the dividend remains unchanged, the yield will fall. Conversely, a decline in share price would push the yield higher.

Additionally, any future changes to the dividend itself would directly impact income projections, regardless of stock price movement.

Recent market action underscores this variability. Alphabet shares recently closed at $312.43 after a decline of 2.4%, a reminder that even high-quality companies experience short-term fluctuations.

For dividend-focused investors, these price movements matter because they influence yield and the total capital required to meet income targets.

In summary, earning $500 per month from Alphabet stock through dividends alone is possible in theory but impractical for most investors due to the large capital commitment required.

Alphabet’s dividend is best viewed as a supplemental benefit rather than a primary income source, appealing most to long-term investors who prioritize growth, stability, and incremental income over high-yield payouts.