Market volatility, trade tensions, and the lingering possibility of a broader economic slowdown have prompted many investors to rethink their strategies.

In environments where uncertainty runs high, dividend-paying stocks often stand out as stabilizing forces. Companies with a history of consistent and growing dividends typically demonstrate strong cash flow, resilient business models, and the ability to weather economic downturns.

One of the dividend ideas highlighted in recent discussions even produced a 3.9% yield and delivered an impressive 14% average annual return over the past five years – a reminder that dependable income stocks can outperform even in choppy markets.

Among the notable contenders for long-term portfolios, UnitedHealth Group and Bank of America present compelling opportunities, though for very different reasons.

1. UnitedHealth Group (UNH)

UnitedHealth Group (UNH) has had a turbulent year, with share prices falling as much as 60% before recovering somewhat to remain down 36% year-to-date.

The decline is fueled largely by the Department of Justice’s investigation into alleged Medicare fraud. While such headlines are never welcome, UnitedHealth’s scale and entrenched position in the healthcare sector make it unlikely that these challenges will permanently damage its long-term prospects.

The company is deeply integrated into a system supported by a growing, aging population that needs continuous medical services.

Its ownership of Optum, a major pharmaceutical and healthcare services provider, adds another layer of diversification and strength.

Despite its challenges, UnitedHealth continues to reward shareholders. Its dividend recently yielded 2.73%, and when combined with buybacks, total shareholder yield reaches approximately 5.75%.

For investors who believe in the company’s resilience and in the essential nature of healthcare services, the current valuation may represent an appealing entry point.

Also See: Why Investors Should Buy Walmart Stock as if Tomorrow Depends on It

2. Bank of America (BAC)

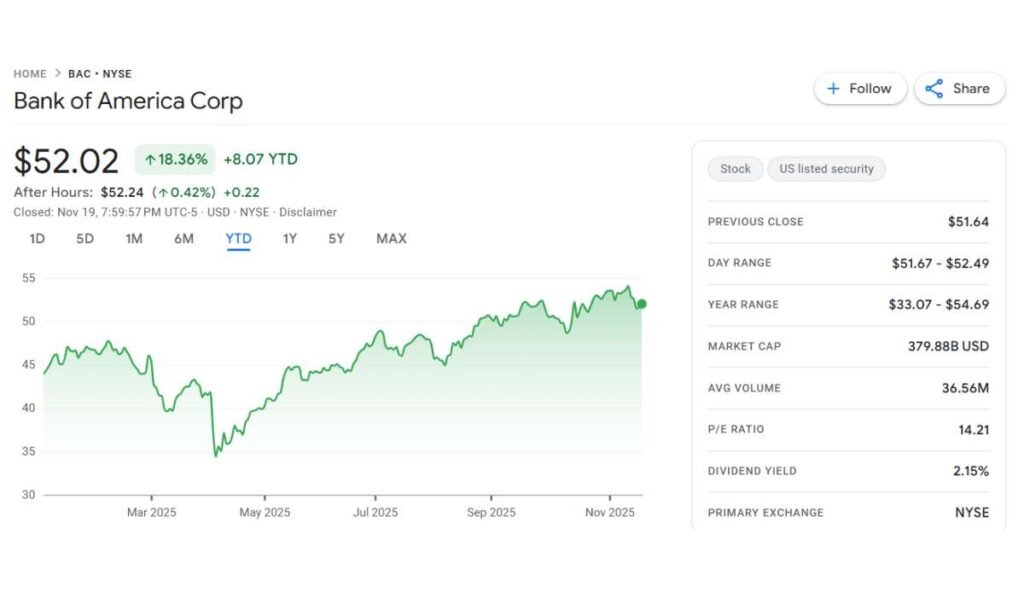

Bank of America (BAC), another major dividend payer, offers a different type of stability. Known as one of Berkshire Hathaway’s most significant holdings, the bank has seen Berkshire gradually reduce its stake, potentially due to pressures from lower interest rates.

Even so, Bank of America is far from one-dimensional. Its expanding consumer investment divisions including wealth management, financial advisory services, and brokerage accounts continue to grow regardless of rate fluctuations.

Shareholders also benefit from a steadily rising dividend. The bank’s recent yield of 2.15% is supported by a payout that has climbed from $0.20 per share in 2015 to $1.06 annually today.

This growth highlights the company’s commitment to returning capital while strengthening its financial footing.

While some ultra-high-yield stocks may tempt investors such as a 17%-yield “bonus” stock often mentioned in dividend circles such unusually high payouts are frequently unsustainable and may signal deeper financial issues.

In contrast, UnitedHealth and Bank of America demonstrate the qualities that long-term investors seek: durability, steady income, and the potential for sustained growth even in unpredictable economic climates.