When former President Donald Trump returned to office, one of his most ambitious economic strategies once again took center stage: Trump Tariffs.

Framed as a tool to bring billions into the U.S. Treasury and reduce dependence on foreign imports, these tariffs have sparked both optimism and criticism.

Supporters argue they generate crucial revenue, while opponents warn of hidden costs that fall directly on American households.

This blog explores what Trump Tariffs are, how they work, the money they bring in, and what their long-term implications could be for the U.S. economy.

How Much Revenue Are Trump Tariffs Generating?

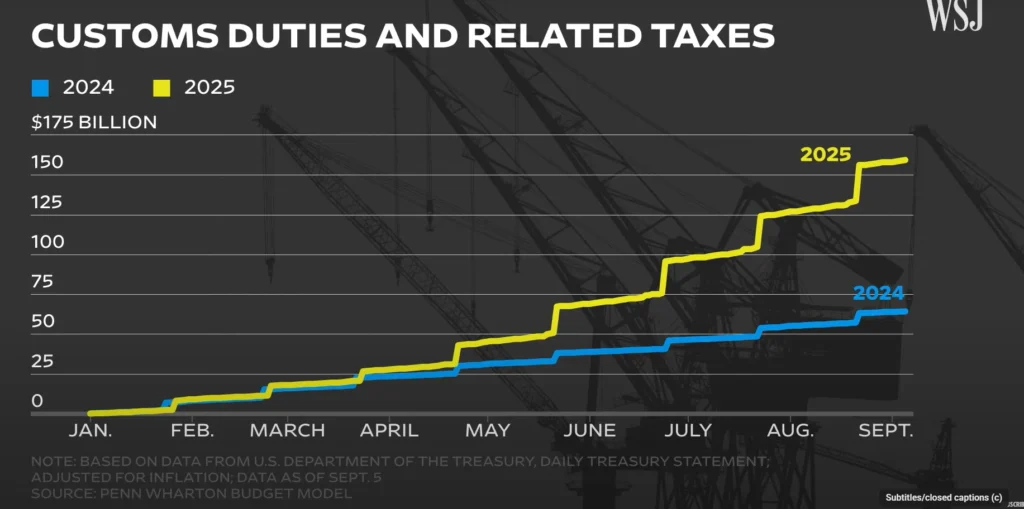

According to the Penn Wharton Budget Model, the U.S. has collected more than $159 billion in tariff revenue as of early September, representing a 148% increase compared to last year.

That equals roughly $642 million per day flowing into the Treasury from tariffs.

Trump has claimed that tariffs have produced “trillions” in revenue. While that figure is exaggerated for now, projections suggest that over the next decade, the federal government could collect nearly $2.9 trillion if current rates remain in place.

Still, in the context of America’s ballooning federal deficit, even these billions represent only a small fraction of what’s needed to stabilize debt.

Who Really Pays for Trump Tariffs?

At first glance, it may seem like foreign exporters are footing the bill. In reality, tariffs are paid by U.S. importers, the companies that bring goods into the country.

Once cargo arrives at U.S. ports, importers must file paperwork with U.S. Customs and Border Protection (CBP), which then assesses the tariff. Importers typically have 10 to 30 days to pay.

The bigger question is: Do importers absorb those costs, or do they pass them on to consumers?

Many businesses have taken creative approaches to soften the impact, including:

- Negotiating lower prices with overseas suppliers.

- Sharing part of the tariff costs with exporters.

- Quietly increasing prices for U.S. consumers—sometimes in subtle ways like raising the minimum for free shipping or removing free shipping altogether.

Ultimately, U.S. households and businesses bear the weight of Trump Tariffs, whether directly through higher prices or indirectly through reduced purchasing power.

Also Read: How Oracle’s Larry Ellison Made $100 Billion in One Day

The China Factor: Tariffs and Port Volatility

A striking example of tariff effects comes from the Port of Los Angeles and Port of Long Beach, America’s busiest cargo hubs.

- In April, when Trump raised tariffs on Chinese goods to 145%, container volumes plunged to their lowest levels in two years.

- By May, tariffs were cut to 30% during negotiations, and cargo surged back. In July, the port complex broke records, handling more than one million containers in a single month.

This volatility highlights how Trump Tariffs create uncertainty for importers and supply chains, leading to swings in port activity, business planning, and consumer prices.

Where Does the Tariff Money Go?

Once collected, tariff revenue flows into the U.S. Treasury’s General Fund often called America’s checkbook. From there, it’s up to Congress to decide how to spend the money.

Trump has floated ambitious ideas for tariff revenue, including:

- Replacing the federal income tax with tariff revenue.

- Issuing rebate checks to American households.

- Paying down the national debt.

But the reality is sobering. Even if tariff revenue reaches projected trillions, it still represents only a small fraction compared to the scale of federal spending and deficits.

Legal and Political Challenges to Trump Tariffs

While Trump continues to champion tariffs as a cornerstone of his economic policy, their legality remains contested.

In August, a federal appeals court ruled that Trump had overstepped his authority by using emergency powers to impose certain tariffs. He called the ruling “highly partisan,” and the case is now headed to the Supreme Court.

This legal uncertainty leaves importers in limbo. Many are waiting to see if tariffs are struck down, potentially allowing them to apply for refunds on billions already paid.

Also Read: Trump’s Tariff Tactics Dealt Major Legal Blow: What’s Next for the United States?

The Long-Term Outlook

Whether or not the courts uphold Trump Tariffs, one thing is clear: tariffs are hard to roll back once imposed. Domestic industries adapt to them, prices adjust, and companies make long-term investments based on trade barriers.

The broader economic questions remain:

- Can tariffs truly generate enough revenue to reduce America’s debt burden?

- Will U.S. households continue absorbing hidden costs without significant backlash?

- How will global trade partners respond to sustained tariff pressure?

For now, Trump Tariffs represent both an immediate revenue boost and a long-term gamble. They have reshaped U.S. trade dynamics, sparked legal battles, and forced businesses and consumers alike to adapt.

The Billionaire Brain Wave

Want to break free from financial worry and start attracting abundance? The Billionaire Brain Wave shows you a fresh, science-backed ritual using theta sound frequencies to tap into your natural money-magnet mindset. J

ust 7 minutes a day, with headphones, can unlock “rich brain waves” that neuroscientists say activate your brain’s wealth-creating power.

It’s easy, done at home, and already helping thousands in over 70 countries replace debt and scarcity with confidence and financial flow.

Right now, you can get instant access for just $39 (down from the original price), backed by a 90-day risk-free guarantee. Tap into your wealth potential today.