When most investors think about the stock market’s heavyweights, trillion-dollar companies like Apple, Microsoft, and Amazon immediately come to mind.

However, the journey to the trillion-dollar club begins with crossing key milestones – one of them being a $300 billion market capitalization.

As of September 2025, only a small fraction of the world’s publicly traded companies have reached that level, which means there is tremendous opportunity for certain growth stocks to rise to the occasion.

Two companies in particular – Advanced Micro Devices (AMD) and Philip Morris International (PM) – are well positioned to cross the $300 billion valuation mark by 2026.

Let’s take a closer look at why these growth stocks stand out.

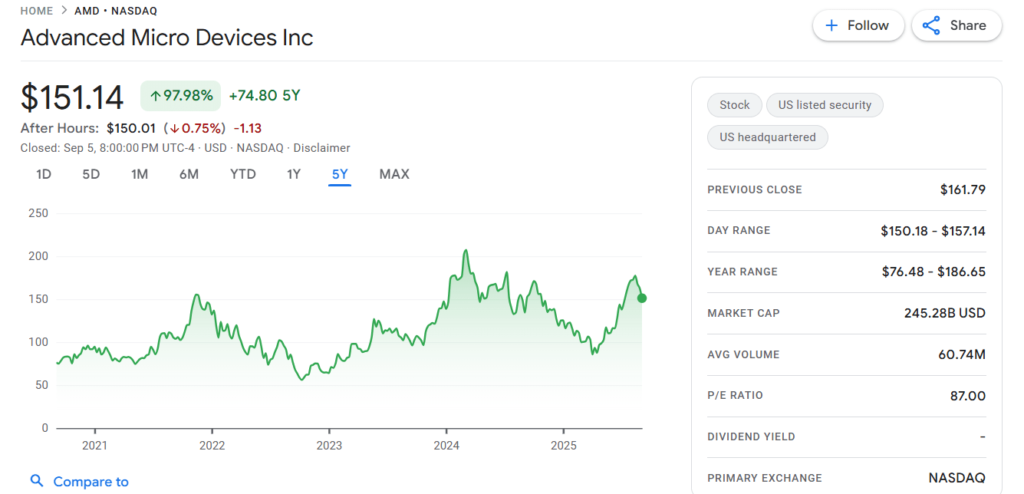

1. Advanced Micro Devices

- Current Market Cap: ~$245 billion

- Upside Needed: ~12%

Advanced Micro Devices (NASDAQ: AMD) has become a household name in the world of semiconductors, thanks to its relentless innovation in CPUs and GPUs.

But what makes AMD one of the most promising growth stocks today is its rising role in the artificial intelligence (AI) market.

For years, Nvidia has dominated AI training workloads. However, AI inference – the process of running trained models in real-world applications is projected to be even larger.

AMD is making significant strides in this space, securing major partnerships with leading AI companies. In fact, seven of the top 10 AI firms already use AMD GPUs for inference workloads.

AMD’s software ecosystem is also improving. While Nvidia’s CUDA has long been the gold standard, AMD’s ROCm 7 release has been specifically optimized for inference, narrowing the gap between the two rivals.

The company is also part of the UALink Consortium, which is working on open-source interconnect solutions that could reduce Nvidia’s hardware lock-in, creating a more competitive AI market.

Beyond GPUs, AMD continues to expand in data center CPUs, capturing market share from Intel.

This market, while smaller than GPUs, is expanding rapidly as demand for cloud computing and AI infrastructure accelerates.

With a solid foothold in both the CPU and GPU segments, AMD has a diverse growth engine fueling its rise.

Given its current valuation, a 12% climb to $300 billion seems very achievable within the next year.

And if AI adoption continues at today’s rapid pace, AMD could be well on its way toward $400 billion or even $500 billion in the coming years.

For investors seeking growth stocks tied to technological megatrends, AMD is hard to ignore.

Also See: Why I Picked Nextra Energy Stock Over Coca Cola Stock as My Top Dividend Stock

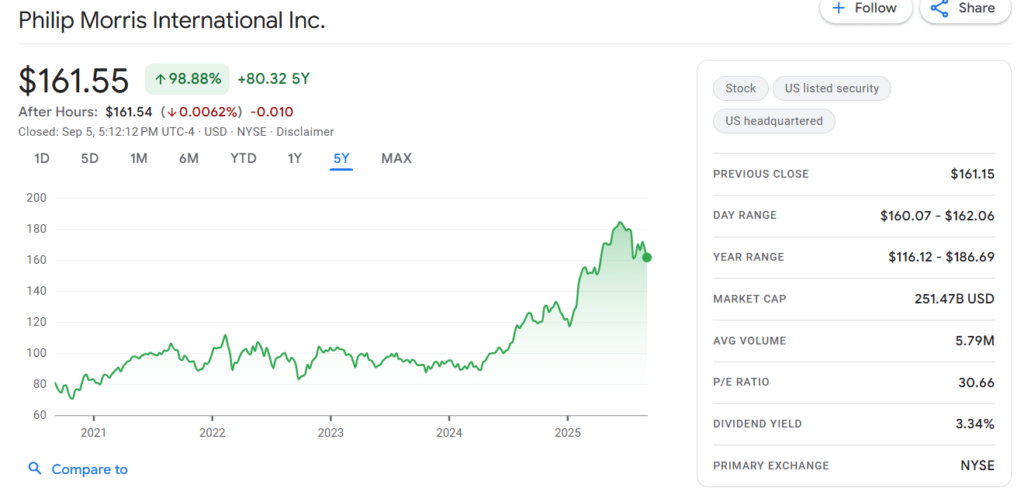

2. Philip Morris International

- Current Market Cap: ~$251 billion

- Upside Needed: ~15%

Philip Morris International (NYSE: PM) might not seem like the typical growth stock, but it has been transforming its business model away from traditional cigarettes toward smokeless alternatives.

This transition is driving both higher volumes and stronger profit margins.

The company’s Zyn nicotine pouches are seeing explosive growth, with U.S. sales volumes up 40% in the latest quarter.

Zyn is also expanding globally, now available in 44 countries. Meanwhile, Iqos, Philip Morris’s heated tobacco product, continues to gain share in Europe, Japan, and other international markets.

Both products are margin-rich, with Zyn generating six times the contribution level of cigarettes and Iqos more than double.

Recent stock dips tied to cigarette volume declines in Turkey spooked some investors, but those challenges appear temporary.

Unlike domestic tobacco companies that face shrinking U.S. cigarette demand, Philip Morris benefits from its global footprint and pricing power, which helps keep overall volumes relatively stable.

Looking ahead, the company’s push to bring Iqos into the U.S. could be a game-changer.

If successful, it would not only accelerate revenue growth but also position Philip Morris as a leader in the next generation of tobacco products.

With strong fundamentals, attractive valuation, and consistent earnings growth, Philip Morris has all the makings of a growth stock that could cross the $300 billion threshold as early as 2026.

Why These Growth Stocks Matter for U.S. Investors

While the headlines often spotlight trillion-dollar giants, the real opportunities for outsized returns may lie in companies on the cusp of joining the $300 billion club.

Both AMD and Philip Morris showcase very different but compelling growth stories – one powered by cutting-edge AI technology and the other by disruptive smokeless tobacco products.

For U.S. investors looking to diversify their portfolios, these two growth stocks represent opportunities to capture gains in industries that are undergoing rapid transformation.

AMD offers exposure to the fast-growing AI and data center markets, while Philip Morris provides access to the high-margin future of global tobacco consumption.

If these companies continue on their current trajectory, investors who buy in today could see strong returns over the next few years.

Whether you’re bullish on tech innovation or consumer product evolution, these growth stocks deserve a place on your watchlist.

The Power of Billionaire Brain Wave

Unlock the power of Billionaire Brain Wave, a 7-minute audio program that harnesses theta brainwave entrainment to sharpen focus, reduce stress, and align your subconscious with abundance.

Backed by neuroscientific research, this easy-to-use digital download helps reprogram your mindset for financial growth – making it a perfect complement to your exploration of high-potential growth stocks.

With a 90-day, no-questions-asked money-back guarantee, it’s a risk-free tool to enrich your journey toward prosperity.