When it comes to building wealth, the stock market has always been one of the most powerful tools available to investors.

While most people invest for steady growth and long-term financial security, history shows that certain companies have achieved astronomical growth turning small investments into life-changing fortunes.

These are often referred to as millionaire stocks because even a modest investment of just $1,000 could have eventually transformed into millions.

Let’s take a look at five famous examples of millionaire stocks that have created unimaginable wealth for those who got in early and held on for the ride.

1. Tesla (TSLA)

- Year of IPO: 2010

- First Day Price: $1.71

- Price in August 2025: $329.13

- $1,000 Investment Value: $2,887,105

Tesla’s journey is nothing short of revolutionary. At its IPO in 2010, Tesla was widely doubted by traditional automakers and Wall Street analysts.

Many questioned whether electric vehicles could ever compete with gas-powered cars.

But those who believed in Elon Musk’s vision and placed a small investment in Tesla’s IPO have since been rewarded beyond imagination.

A $1,000 stake back in 2010 would now be worth nearly $2.9 million.

Tesla’s growth was fueled by its dominance in electric vehicle innovation, expansion into energy storage, and global adoption of clean technologies.

Tesla is the perfect example of how visionary companies can become millionaire stocks when disruptive ideas meet strong execution.

2. Netflix (NFLX)

- Year of IPO: 2002

- First Day Price: $7.02

- Price in August 2025: $1,225.35

- $1,000 Investment Value: $2,443,718

Back in the early 2000s, Netflix was best known for mailing DVDs to subscribers. Very few people could have predicted that it would one day become a global streaming powerhouse.

At its IPO, a single share cost just over $7.

Fast forward to 2025, and that same share is now worth over $1,200. A $1,000 investment in 2002 would have grown into more than $2.4 million.

Netflix’s success story highlights how adapting to technology trends like streaming, original content production, and global expansion can turn a company into one of the greatest millionaire stocks of all time.

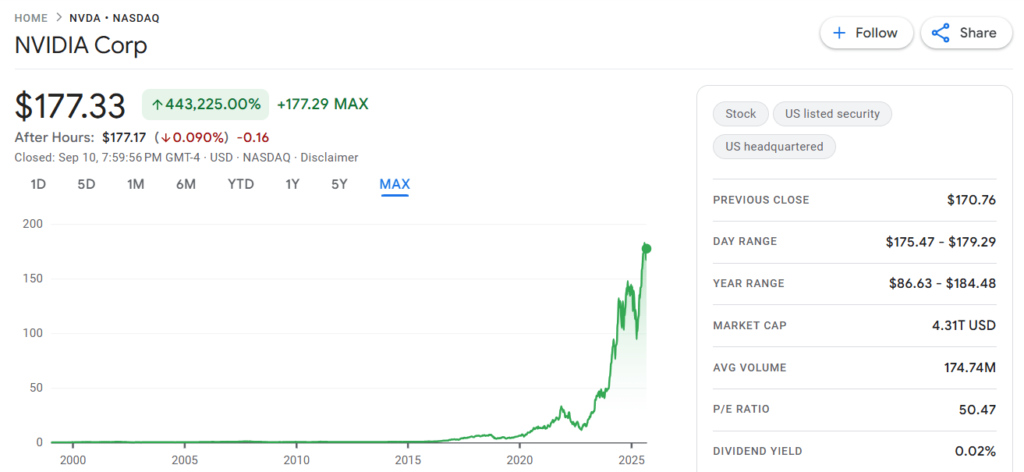

3. Nvidia (NVDA)

- Year of IPO: 1999

- First Day Price: $0.44

- Price in August 2025: $144.69

- $1,000 Investment Value: $15,784,364

Perhaps the most mind-blowing example on this list is Nvidia. At its IPO in 1999, the graphics card manufacturer was worth less than a dollar per share.

But today, Nvidia dominates artificial intelligence, gaming, and data centers.

A $1,000 investment in Nvidia’s IPO would now be worth over $15.7 million. This makes it one of the most powerful millionaire stocks in history.

Nvidia’s meteoric rise is tied to the explosive demand for GPUs in AI, cloud computing, and autonomous driving.

It serves as proof that sometimes the most underestimated companies can generate the largest returns.

Also Read: Nvidia Stock Price Prediction: Can NVDA Hit $600 by 2030?

4. Amazon (AMZN)

- Year of IPO: 1997

- First Day Price: $6.70

- Price in August 2025: $216.10

- $1,000 Investment Value: $7,740,896

When Amazon went public in 1997, it was just an online bookstore.

Few could have imagined that Jeff Bezos’ company would eventually reshape the way the world shops, becoming the largest e-commerce platform and cloud services provider in history.

That early $1,000 investment would now be worth more than $7.7 million.

Amazon’s transformation into a trillion-dollar company was powered by relentless innovation from Prime memberships to cloud computing with AWS.

It remains one of the most iconic millionaire stocks, proving how betting on disruptive business models can create generational wealth.

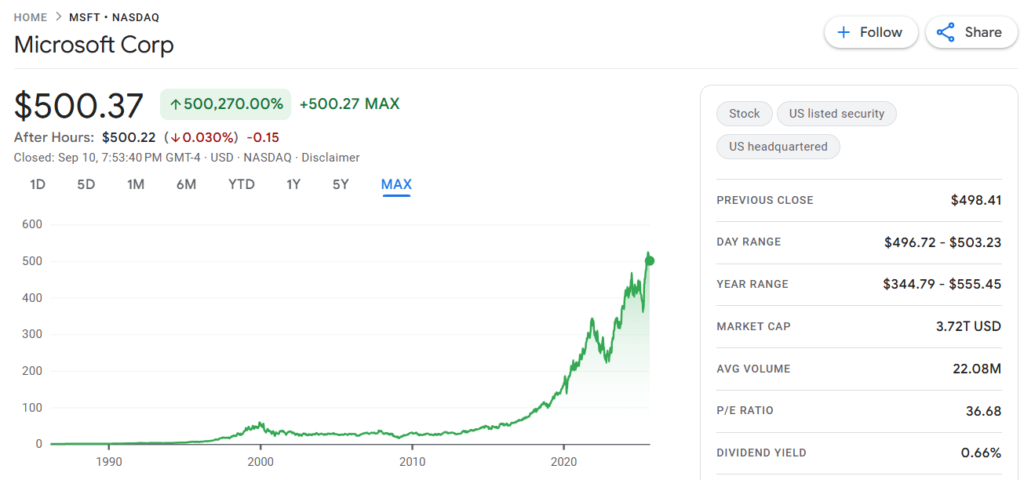

5. Microsoft (MSFT)

- Year of IPO: 1986

- First Day Price: $31.10

- Price in August 2025: $479.14

- $1,000 Investment Value: $4,437,052

Microsoft’s IPO in 1986 marked the beginning of one of the most influential companies in tech history.

With Windows and Office dominating personal computing, and later with cloud computing through Azure, Microsoft has maintained its leadership for nearly four decades.

A $1,000 stake in Microsoft’s IPO would have grown into over $4.4 million.

This shows that patience and long-term conviction can turn ordinary companies into extraordinary millionaire stocks.

Microsoft continues to thrive, making it a cornerstone of many investment portfolios today.

Lessons from Millionaire Stocks

These five companies – Tesla, Netflix, Nvidia, Amazon, and Microsoft share some key lessons for investors:

- Innovation Drives Growth: Each of these businesses disrupted industries through new technologies or business models.

- Patience Pays Off: It often took decades for these investments to reach millionaire levels. Long-term holding is essential.

- Spotting Trends Early Matters: From e-commerce to streaming to AI, recognizing emerging trends before they go mainstream can lead to extraordinary returns.

- Risk and Reward Go Hand-in-Hand: At the time of their IPOs, none of these companies were sure bets. Many were doubted by experts.

The stories of these millionaire stocks prove that even small amounts of money, wisely invested, can lead to life-changing wealth.

While it’s unlikely that every stock you buy will turn $1,000 into millions, history shows that visionary companies with disruptive technologies have the potential to do exactly that.

For modern investors in the U.S., the key is not to chase past success but to look for future opportunities where innovation meets demand.

The next Tesla, Netflix, or Nvidia could be out there right now – waiting to turn today’s small investment into tomorrow’s fortune.

Think Like a Millionaire Investor

If you’re serious about discovering strategies that can help you think bigger and potentially spot the millionaire stocks of tomorrow—Billionaire Brainwave might be right up your alley.

This program claims to tune your mindset for wealth, teaching you mental frameworks, habits, and decision skills that can enhance your investment instincts.

For anyone intrigued by turning a modest stake into substantial gains, this could help sharpen the edge between average returns and extraordinary success.

Always pair tools like these with smart research and due diligence.