When it comes to blue-chip companies, few names carry as much weight as Coca-Cola. Traded under NYSE: KO, Coca-Cola stock has been a staple in many long-term investment portfolios for decades.

Known for its global reach, steady revenue stream, and consistent dividend history, Coca-Cola is often considered a defensive stock one that can weather economic ups and downs.

However, before you decide to buy shares, there are three key things every U.S. investor should know about Coca-Cola stock.

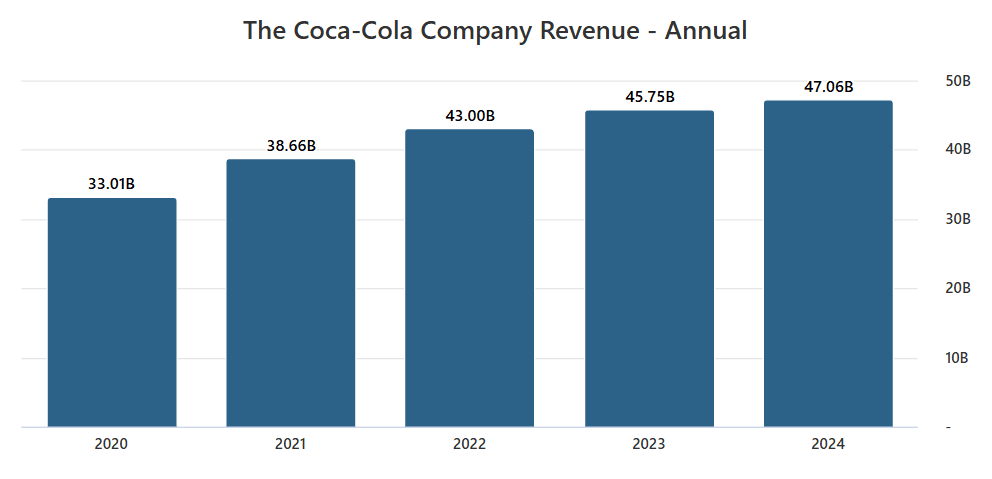

1. Revenue Is Still Below Record Levels

Coca-Cola is one of the most recognized brands in the world, but its revenue story hasn’t always been on a straight upward path.

The company saw its peak revenue back in 2012 when it generated more than $48 billion. In the years since, Coca-Cola has streamlined its portfolio, sold off some bottling operations, and refocused on its core beverage business.

While revenue has improved in recent years, it still hasn’t surpassed that all-time high. For investors, this signals two things: Coca-Cola has room to grow, but it’s also operating in a highly competitive environment with shifting consumer preferences.

Americans today are increasingly choosing healthier beverages, flavored water, and low-sugar options.

The good news is that Coca-Cola is adapting by expanding into these categories, but potential investors in NYSE: KO should understand that revenue growth is steady rather than explosive.

Also See: Why You Should Consider Buying This Robotics Stock Under $20

2. Coca-Cola Owns More Than 200 Brands

Most people immediately think of the iconic red can when they hear “Coca-Cola,” but the company is much more than soda.

In fact, Coca-Cola owns over 200 different brands across a wide range of categories, including bottled water, sports drinks, tea, coffee, juices, and even plant-based beverages.

Popular names like Dasani, Powerade, Minute Maid, Costa Coffee, and Honest Tea all fall under the Coca-Cola umbrella.

For investors, this diversification is a major advantage. The U.S. beverage market is constantly evolving, and having a broad portfolio helps protect the company against changing consumer habits.

For example, as soda consumption has declined in the U.S., sales of sparkling water and zero-sugar alternatives have grown. Coca-Cola’s ability to pivot its strategy and lean on its extensive brand lineup gives Coca-Cola stock long-term resilience.

This global footprint also provides protection against economic downturns in any single region. Even if sales in North America slow, strong demand in emerging markets like Asia or Africa can offset the difference.

This international diversification makes NYSE: KO a more stable option compared to smaller beverage companies.

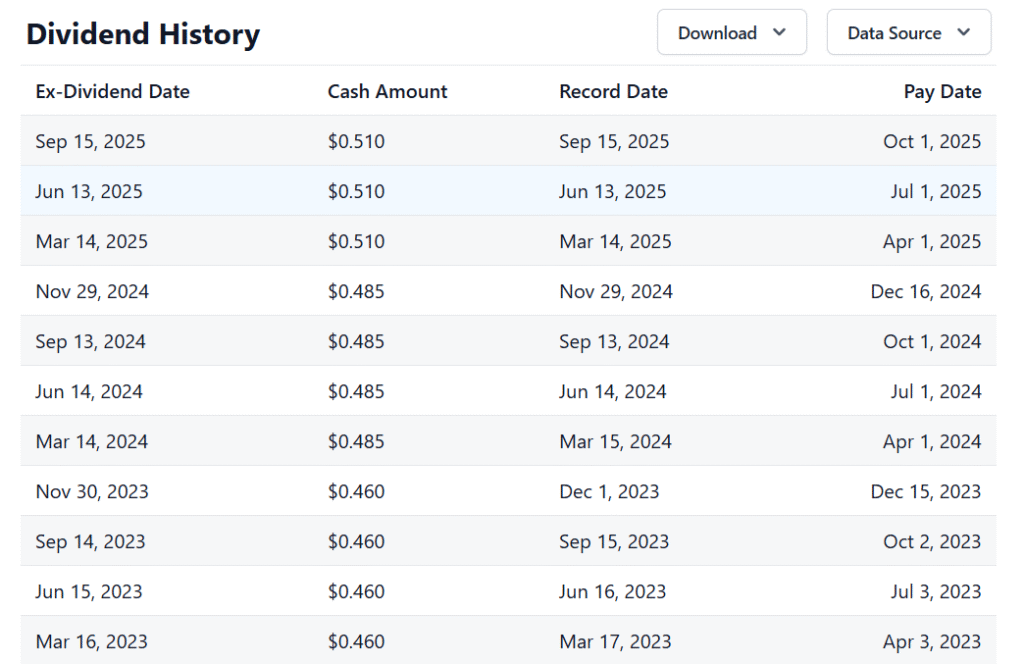

3. Coca-Cola Is a Dividend King

One of the biggest reasons U.S. investors consider Coca-Cola stock is its dividend. Coca-Cola is part of a rare group of companies known as Dividend Kings businesses that have increased their dividend payouts for at least 50 consecutive years.

In fact, Coca-Cola has raised its dividend for more than six decades.

For retirees or income-focused investors, this track record is hard to beat. The current dividend yield of NYSE: KO hovers around 3%, making it an attractive option for those seeking regular income.

While the yield may not be as high as some riskier dividend stocks, Coca-Cola’s consistency and financial strength provide peace of mind.

In uncertain economic times, dividend stability is a huge advantage. Many U.S. investors view Coca-Cola stock not only as a defensive play but also as a reliable source of passive income.

Also See: 2 Dividend Growth Stocks Beating Inflation and Growing Payouts

Transform Your Thinking, Grow Your Wealth

Looking beyond traditional investments like Coca-Cola stock, NYSE: KO? The Billionaire Brain Wave offers an intriguing, neuroscience-based program designed to unlock your inner mindset for abundance.

Through a simple daily 7-minute sound ritual, it claims to activate your “Theta brain wave” to attract money, opportunities, and improved financial confidence.

For investors growing their portfolio with NYSE: KO or dividend-paying giants, this could serve as a mindset booster alongside your stock strategy.

With a 90-day money-back guarantee, it’s a low-risk way to explore mental tools that may compound your financial outlook.